Condo Insurance in and around Walkersville

Townhome owners of Walkersville, State Farm has you covered.

Quality coverage for your condo and belongings inside

Home Is Where Your Heart Is

There is much to consider, like coverage options savings options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be an overwhelming decision. Not only is the coverage impressive, but it is also surprisingly well priced. And that's not all! The coverage can help provide protection for your condo and also your personal property inside, including things like home gadgets, clothing and pictures.

Townhome owners of Walkersville, State Farm has you covered.

Quality coverage for your condo and belongings inside

Safeguard Your Greatest Asset

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Jonathan Greenberg can be there whenever you have problems at home to help you submit your claim. State Farm is there for you.

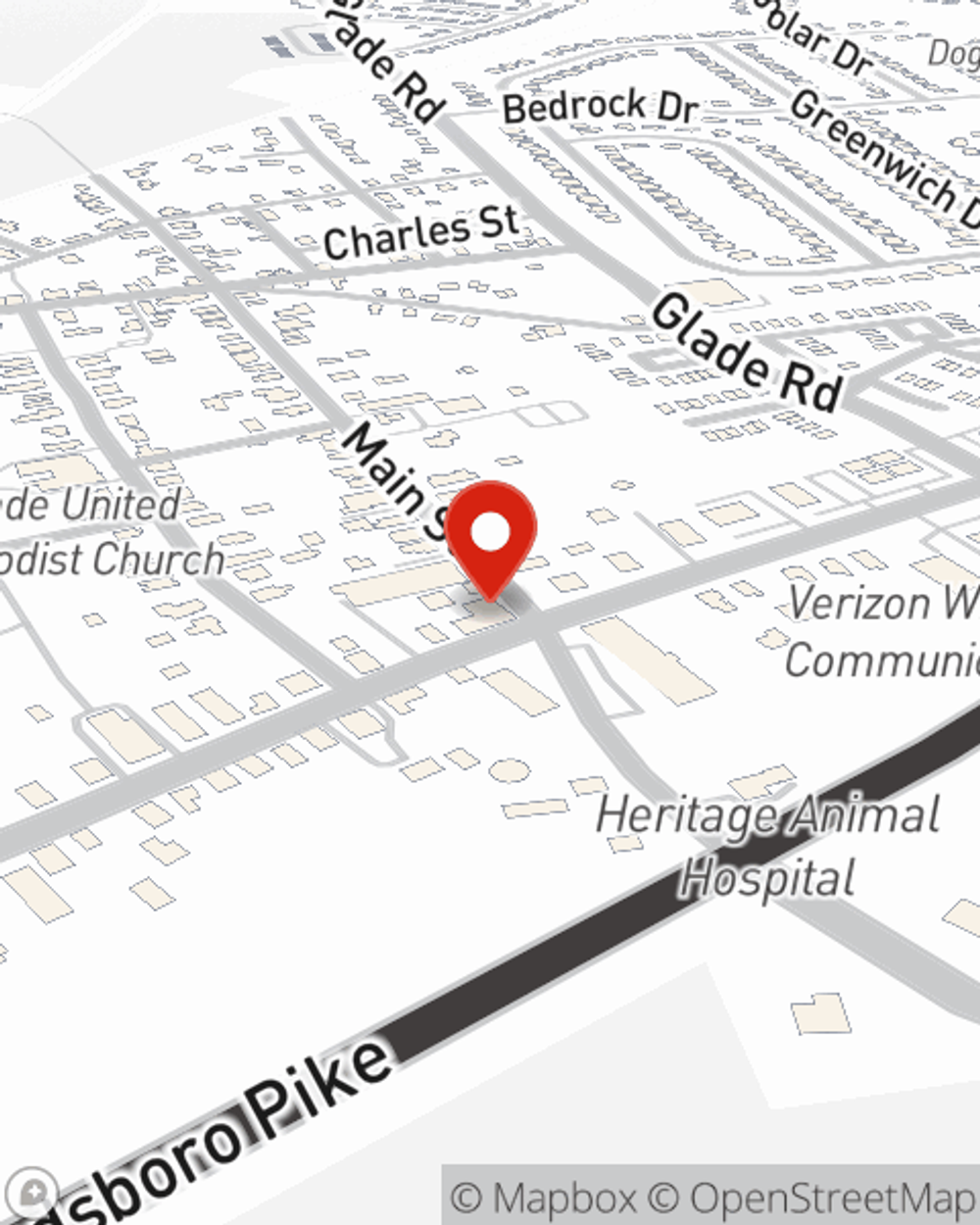

As a commited provider of condo unitowners insurance in Walkersville, MD, State Farm helps you keep your home protected. Call State Farm agent Jonathan Greenberg today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Jonathan at (301) 304-3043 or visit our FAQ page.

Simple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Jonathan Greenberg

State Farm® Insurance AgentSimple Insights®

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.